Highlighting the Shift to Algorithmic Approaches

In today’s fast-paced financial landscape, automated decisions are no longer a luxury—they’re a necessity for savvy investors.

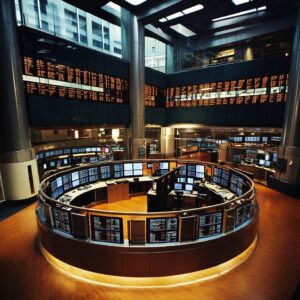

The Rise of Algorithmic Trading in Decentralized Markets

The rise of algorithmic trading in decentralized markets

In 2020 alone, the volume of trades executed through algorithmic trading strategies surged, accounting for over 70% of all equity trades in the U.S. markets. This staggering transformation is not confined to traditional financial ecosystems; it is now permeating decentralized markets, where blockchain technologies are rewriting the rules of trading. As investors seek efficiency and precision, algorithmic trading offers a tantalizing solution, promising to optimize transactions in environments previously thought to be unstructured.

The importance of algorithmic trading in decentralized markets cannot be overstated. As decentralized finance (DeFi) platforms proliferate, they challenge the status quo of traditional finance by eliminating intermediaries and democratizing access to trading opportunities. This article will delve into the mechanisms of algorithmic trading, its burgeoning role in fostering liquidity and transparency within decentralized platforms, and the potential challenges it faces as the landscape evolves. By unpacking these elements, readers will gain a comprehensive understanding of how algorithmic trading is reshaping the future of finance.

Understanding the Basics

Algorithmic trading

Algorithmic trading refers to the use of computer algorithms to automate the process of trading financial instruments, allowing for quicker decision-making and execution. In traditional centralized markets, these algorithms analyze historical data and current market conditions to execute trades at optimal prices, improving efficiency and profitability. Recent advancements in technology and the rising popularity of decentralized markets–created by blockchain technology–have expanded the scope of algorithmic trading beyond conventional settings.

Decentralized markets operate on peer-to-peer networks, where transactions occur directly between parties without intermediaries. This shift has introduced a new layer of complexity for algorithmic trading, as it requires traders to adapt their strategies to accommodate the unique characteristics of blockchain technology. For example, the Ethereum blockchain allows for the creation of decentralized applications (dApps) that can incorporate smart contracts, automatically executing trades based on predetermined criteria. This capability enables traders to set rigid parameters for executing transactions, reducing human error and reaction time.

Statistics point to the growing influence of algorithmic trading in decentralized markets. A report by the International Organization of Securities Commissions (IOSCO) indicated that algorithmic trading accounts for approximately 60% of all trading activity in major stock exchanges, illustrating its potential dominance. Also, decentralized finance (DeFi) platforms, which facilitate algorithmic trading through automated liquidity provision and market-making strategies, have seen a surge in value, surpassing $100 billion in total value locked as of Q3 2023. This rapid growth signals a shift in how trades are conducted and highlights the need for investors to understand the intricacies of this evolving landscape.

Key Components

Decentralized markets

Algorithmic trading in decentralized markets has transformed the landscape of financial trading by automating transaction processes and leveraging advanced data analytics. This technology relies on algorithms–complex mathematical formulas and software instructions–to execute trades at speeds and volumes that manual trading cannot match. As the cryptocurrency market evolves, particularly with the advent of decentralized finance (DeFi), understanding the key components of algorithmic trading becomes essential for participants looking to optimize their strategies and enhance market efficiency.

Several critical components define the operational framework of algorithmic trading in decentralized markets

- Algorithm Design: The foundation of any algorithmic trading strategy is its design. Traders must define specific parameters, such as entry and exit points, risk management rules, and trade selection criteria. For example, a common strategy might involve arbitrage, where traders exploit price discrepancies across different platforms.

- Execution Systems: Execution mechanisms are vital for ensuring that trades are carried out quickly and effectively. Systems such as smart contracts on blockchain platforms automate order fulfillment while minimizing the risk of human error. According to a 2022 report by Chainalysis, decentralized exchanges facilitated nearly $1 trillion in trading volume, underscoring the need for efficient execution systems.

- Market Data Analytics: Real-time data analytics is crucial for algorithmic trading, as traders need access to market trends and trading volumes to adapt their strategies swiftly. Advanced analytics tools can analyze vast datasets within seconds, providing insights that inform trading decisions. For example, the use of sentiment analysis tools enables traders to gauge market moods based on social media activity, enhancing their predictive capabilities.

- Risk Management: Useing robust risk management frameworks is essential in algorithmic trading to mitigate potential losses. Traders often set parameters for maximum loss or use stop-loss orders to automatically execute trades once a specified price is reached. The integration of machine learning models can further refine risk assessment, adapting strategies based on past performance and market conditions.

Collectively, these components not only streamline trading operations but also foster a more efficient market structure. As decentralized markets continue to expand, understanding and effectively employing these key elements will be paramount for traders looking to navigate this rapidly evolving landscape successfully.

Best Practices

Blockchain technology

As algorithmic trading continues to proliferate in decentralized markets, it is essential for traders and institutions to adopt best practices to navigate this rapidly evolving landscape effectively. Useing these practices can enhance trading efficiency, mitigate risks, and optimize return potential.

- Understand the Market Dynamics Familiarize yourself with the underlying principles of decentralized markets. Unlike traditional stock exchanges, decentralized platforms operate without a central authority, which affects liquidity, volatility, and trading strategies. For example, Ethereums decentralized finance (DeFi) protocols have introduced unique challenges and opportunities that differ from centralized trading environments.

- Backtesting and Simulation: Before deploying any algorithm, conduct thorough backtesting and simulation under various market conditions to evaluate its performance. This involves analyzing historical data and stress-testing your algorithm against scenarios like extreme volatility or low liquidity. Studies show that algorithms that are rigorously tested can outperform those that are not by as much as 30% in volatile conditions.

- Use Robust Risk Management Strategies: Given the inherent risks of algorithmic trading, particularly in decentralized markets, it is vital to incorporate comprehensive risk management frameworks. This includes setting appropriate stop-loss orders, diversifying trading strategies, and maintaining a clear understanding of your risk tolerance. Data shows that traders who utilize such frameworks can reduce potential losses by up to 40% compared to those who do not.

- Stay Updated on Regulatory Changes: The regulatory landscape for decentralized markets is continually evolving. Being aware of changes in the legal framework can help traders avoid unforeseen penalties and ensure compliance. Regularly review guidelines from governing bodies and consider joining professional networks to stay informed on best practices and regulatory developments.

By adhering to these best practices, traders can position themselves to leverage the advantages of algorithmic trading in decentralized markets while minimizing associated risks. This proactive approach can lead to more informed decision-making and ultimately more successful trading outcomes.

Practical Implementation

Trading efficiency

The Rise of Algorithmic Trading in Decentralized Markets

Practical Useation

The rise of algorithmic trading in decentralized markets has transformed how traders access and execute trades. This section provides a practical guide to implementing algorithmic trading strategies in decentralized finance (DeFi) environments.

1. Step-by-Step Instructions for Useing Algorithmic Trading: Financial ecosystems

Step 1: Define Your Trading Strategy

Before implementing an algorithmic trading system, clearly define your trading strategy. Consider aspects such as:

- Market conditions (bullish, bearish, or sideways)

- Indicators to use (moving averages, RSI, MACD)

- Risk management aspects (stop-loss, take-profit levels)

Step 2: Choose Your Decentralized Platform

Select a decentralized exchange (DEX) to operate on, such as:

- Uniswap

- Curve Finance

- Balancer

Step 3: Set Up Your Development Environment

Install the necessary tools and libraries:

- Node.js: For JavaScript execution

- Web3.js: To interact with Ethereum blockchain

- Solidity: For writing smart contracts

- Python: For statistical analysis and backtesting

- Trading libraries: e.g.,

ccxtfor interaction with various exchanges

Step 4: Write the Algorithm

Use your trading algorithm using a programming language such as JavaScript or Python. Heres a simple pseudocode example of a moving average crossover strategy:

function movingAverageCrossover(symbol, shortWindow, longWindow) { prices = fetchHistoricalPrices(symbol) shortMA = calculateMovingAverage(prices, shortWindow) longMA = calculateMovingAverage(prices, longWindow) if (shortMA > longMA) { executeTrade(symbol, buy) } else if (shortMA < longMA) { executeTrade(symbol, sell) }}

Step 5: Deploy the Smart Contract

Once your algorithm is thoroughly tested, deploy a smart contract using Remix IDE or Truffle Suite. Ensure that it includes:

- Trade execution functions

- Emergency withdrawal functionality

- Events for logging trades

2. Tools, Libraries, or Frameworks Needed

To streamline the implementation process, you will need the following tools:

- Node.js: For server-side JavaScript execution.

- npm or yarn: To manage packages.

- Truffle Suite: For Ethereum development.

- Infura: For connecting to the Ethereum network.

- Metamask: A web wallet for transaction signing and management.

3. Common Challenges and Solutions

Challenge 1: Slippage

High volatility in decentralized markets can lead to slippage in order execution.

Solution: Use a price tolerance level and limit orders to avoid excessive slippage.

Challenge 2: Gas Fees

Transaction fees can fluctuate significantly.

Solution: Optimize gas usage in your smart contracts and consider trading at lower traffic times.

Challenge 3: Market Manipulation

Decentralized markets are less regulated, which can lead to price manipulation.

Solution: Incorporate alert systems for unusual trading volumes and patterns.

4. Testing and Validation Approaches

Backtesting

Use historical data to evaluate your trading strategys performance. Libraries like Backtrader in Python can assist with this:

import backtrader as btclass MyAlgorithm(bt.Strategy): # Define strategy logiccerebro = bt.Cerebro()cere

Conclusion

To wrap up, the rise of algorithmic trading in decentralized markets marks a pivotal shift in how trading strategies are executed. We explored the fundamental mechanics of algorithmic trading, highlighting its ability to analyze vast datasets and execute trades at lightning speeds, thus enhancing market efficiency. The integration of advanced algorithms has not only democratized trading opportunities but also introduced a new level of complexity and risk management that can benefit both professional and retail traders alike. Also, with decentralized finance (DeFi) continuing to grow, the reliance on algorithmic systems is becoming more prominent, reshaping traditional finance paradigms.

The significance of this evolution cannot be overstated, as it opens doors to more inclusive financial markets while posing challenges that necessitate robust regulatory frameworks. As traders maneuver through this digital landscape, it becomes crucial to understand not just the mechanics of algorithms, but also the ethical implications and potential market manipulations associated with their use. As we forge ahead, let us remain vigilant and proactive in shaping the future of trading, ensuring that the benefits of algorithmic strategies are harnessed responsibly. In a world increasingly driven by technology, the question is

are we prepared to embrace this transformation and ensure it serves the collective interests of the market?