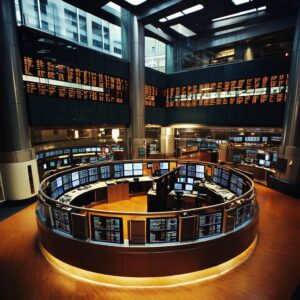

Spotlighting the Power of Data

Data-driven insights are transforming the way we approach investing. Here’s how algorithms are reshaping the rules.

Did you know that the cryptocurrency market capitalization soared past $800 billion in late 2023, marking a staggering growth trajectory despite its notorious volatility? As more investors turn their attention to the digital asset space, managing crypto portfolios effectively has become a vital skill. In this environment, algorithmic tools have emerged as game-changers, leveraging data analytics and artificial intelligence to navigate the complexities of cryptocurrency investing.

This article delves into the world of algorithmic tools specifically designed for crypto portfolio management. We will explore how these technologies not only streamline the decision-making process but also enhance risk assessment and optimize returns. From automated trading strategies to sophisticated risk management algorithms, we will examine the practical applications of these tools, their benefits and limitations, and provide case studies highlighting their effectiveness. By the end, you will have a comprehensive understanding of how to harness algorithmic solutions to maximize your crypto investment potential.

Understanding the Basics

Algorithmic trading tools

In the rapidly evolving world of cryptocurrencies, managing a portfolio can be a daunting task. Understanding the basics of algorithmic tools designed for this purpose is crucial for investors looking to optimize their strategies and mitigate risks. Algorithmic trading tools employ complex mathematical models to make decisions about buying, selling, or holding assets, streamlining the management process and reducing the emotional impact of trading.

These tools often utilize various algorithms that assess market trends, historical data, and real-time price movements to determine the best course of action. For example, a momentum trading algorithm might analyze the price movements of Bitcoin and Ethereum, making trades based on recently observed trends, while a mean reversion algorithm would look for price extremes and make trades betting on a return to average levels. By leveraging such algorithms, investors can enhance their ability to respond swiftly to market fluctuations, which is particularly important given that cryptocurrency markets are open 24/7.

Also, incorporating algorithmic tools can lead to greater diversification within a portfolio. Many platforms enable users to implement strategies across multiple cryptocurrencies simultaneously, thereby spreading risk and potentially enhancing returns. According to a study by Deloitte, asset managers that employ algorithmic trading can experience up to a 20% increase in their portfolio performance compared to those who do not utilize these tools. This data underscores the efficacy of algorithmic trading in todays volatile market conditions.

In summary, algorithmic tools are essential for modern cryptocurrency portfolio management. They provide a systematic approach to trading, allow for real-time decision-making based on data analysis, and enable greater diversification. As the landscape continues to grow and change, embracing these solutions can empower investors to navigate the complexities of crypto investing with greater confidence and effectiveness.

Key Components

Crypto portfolio management

When navigating the complexities of cryptocurrency investments, a well-structured portfolio management strategy is essential. Algorithmic tools have emerged as vital assets in this space, facilitating effective oversight and optimization of portfolios. The key components of these tools encompass several critical functionalities designed to enhance investment decision-making and risk management.

- Data Aggregation Algorithmic tools excel in aggregating vast amounts of market data from various sources. This includes real-time price feeds, trading volumes, and news sentiment analysis. For example, platforms like CoinMarketCap and CryptoCompare provide APIs that allow investors to gather extensive data efficiently, enabling informed strategic shifts.

- Automated Trading Strategies: Algorithms can execute pre-defined trading strategies, such as arbitrage or trend following, faster than human traders. For example, a bot programmed to execute trades when the price of Bitcoin falls below a certain threshold can capitalize on market inefficiencies within milliseconds, a task too slow for human intervention.

- Risk Assessment and Portfolio Diversification: Effective algorithmic tools incorporate models that measure volatility and assess risk, allowing investors to diversify their portfolios strategically. According to studies by the CFA Institute, diversified portfolios generally yield higher returns with lower volatility, further highlighting the importance of this feature in algorithmic tools.

- Performance Analytics: To evaluate investment success, algorithmic tools often include performance metrics and analytics dashboards. These tools enable users to track key performance indicators (KPIs) like return on investment (ROI) and Sharpe ratios over time. For example, platforms like Shrimpy provide visualization tools that help investors understand their portfolios performance compared to market benchmarks.

By leveraging these components, investors can create more robust, responsive, and data-driven crypto portfolios. integration of algorithmic tools not only enhances operational efficiency but also empowers investors to make strategic decisions rooted in comprehensive data analysis. As the crypto market continues to evolve, the importance of these algorithms will only increase, making them indispensable in any forward-thinking investment strategy.

Best Practices

Data analytics in cryptocurrency

When delving into the realm of algorithmic tools for managing cryptocurrency portfolios, adhering to best practices is essential for maximizing returns while minimizing risks. One of the foremost considerations is the integration of a well-defined investment strategy. This includes not only setting clear objectives but also determining asset allocation and risk tolerance. For example, a conservative investor may opt for a higher percentage allocation in stablecoins, such as USDC or Tether, whereas a risk-tolerant investor might diversify across high-volatility altcoins.

Another key best practice is to leverage backtesting and simulation features provided by many algorithmic tools. Backtesting allows investors to assess how a specific trading strategy would have performed historically, using actual market data. As per data from a 2021 report by CryptoCompare, portfolios that employed backtested strategies saw an average return enhancement of 25% compared to those that did not. Utilizing simulation models can further help in understanding potential future performance and refining strategies accordingly.

Also, maintaining a vigilant approach toward real-time analytics and market trends is crucial. Employing tools that offer comprehensive dashboard views with metrics on market volatility, trading volumes, and price movements can greatly aid in making informed decisions. Algorithms can also adjust strategies based on these inputs, executing trades automatically to capitalize on market inefficiencies.

- Define your investment strategy Clearly specify your goals and risk tolerance.

- Use backtesting: Analyze historical performance of trading strategies.

- Monitor market trends: Use real-time analytics to adjust strategies dynamically.

- Diversify your portfolio: Spread investments across various assets to mitigate risks.

Practical Implementation

Digital asset investment strategies

Exploring Algorithmic Tools for Managing Crypto Portfolios

Market capitalization trends

As the cryptocurrency market continues to evolve, managing a crypto portfolio effectively requires the integration of algorithmic tools. This section provides a step-by-step guide on how to implement these tools, ensuring an actionable and practical approach.

1. Step-by-Step Instructions for Useation

The implementation can be broken down into several key steps:

- Define Your Investment Strategy:

Before diving into coding, outline your investment goals–whether its to maximize gains, minimize risk, or achieve a balance of both. Consider strategies like dollar-cost averaging, momentum trading, or mean reversion.

- Select a Programming Language:

Python is widely recommended due to its extensive libraries for data analysis and financial modeling.

- Set Up Your Development Environment:

Install the necessary tools:

- Python 3.x

- Jupyter Notebook for interactive coding

- Pandas, NumPy, Matplotlib for data manipulation and visualization

- CCXT library to interact with cryptocurrency exchanges

- Data Collection:

Use the CCXT library to download historical price data and account balances from various crypto exchanges.

import ccxtexchange = ccxt.binance()markets = exchange.load_markets()ohlcv = exchange.fetch_ohlcv(BTC/USDT, 1d) # 1-day candlesticks - Develop Algorithms for Portfolio Management:

Use your trading algorithms based on the chosen strategy:

def buy_signal(data): if data[close].iloc[-1] > data[close].iloc[-2]: # Simple Moving Average crossover return True return False - Backtest Your Strategy:

Evaluate the performance of your strategy using historical data.

def backtest(data): for index, row in data.iterrows(): if buy_signal(row): print(fBuy at {row[close]}) - Deploy Live Trading:

Once backtesting shows promise, deploy your algorithm with real funds using the CCXT library to place trades.

if buy_signal(latest_data): exchange.create_market_order(BTC/USDT, buy, amount)

2. Tools, Libraries, or Frameworks Needed

Also to Python, heres a summary of essential tools:

- CCXT: A library to connect with multiple exchanges for data retrieval and trading activities.

- Pandas: A library for data manipulation and analysis.

- NumPy: For numerical calculations and operations.

- Matplotlib: For visualizing data through charts and graphs.

- Tweepy: If you are using social media sentiment for trading signals, this library can fetch Twitter data.

3. Common Challenges and Solutions

There are several challenges when implementing algorithmic tools for crypto portfolio management:

- Market Volatility: Cryptocurrencies are notoriously volatile, which may lead to unexpected losses. Solution: Incorporate stop-loss orders and use strategies like diversification to mitigate risks.

- Data Quality: Ensuring the accuracy and completeness of historical data can be problematic. Solution: Use multiple sources for data and validate against known values.

- Latency Issues: The speed of executing trades can impact profitability. Solution: Optimize your code and consider using lower-level programming languages for performance-critical sections.

4. Testing and Validation Approaches

To ensure your algorithms are robust, the following testing approaches

Conclusion

To wrap up, exploring algorithmic tools for managing crypto portfolios unveils a transformative approach to investing in the volatile world of digital currencies. We discussed how these sophisticated tools, ranging from automated trading systems to artificial intelligence algorithms, can enhance decision-making by analyzing market trends, optimizing asset allocation, and minimizing risk. By harnessing vast amounts of data and employing machine learning techniques, investors can make informed choices that human intuition alone may fail to achieve in such a rapidly changing landscape.

The significance of utilizing algorithmic tools in crypto portfolio management cannot be overstated, especially given the unique challenges posed by market volatility and the complexity of blockchain technology. As the cryptocurrency market continues to evolve, those who harness these innovative solutions will likely maintain a competitive edge. As you navigate this dynamic environment, consider adopting algorithmic strategies that align with your investment goals. The future of crypto investing is not just about understanding the market; its about leveraging technology to make smarter decisions. Will you embrace the tools that can potentially redefine your investment journey?