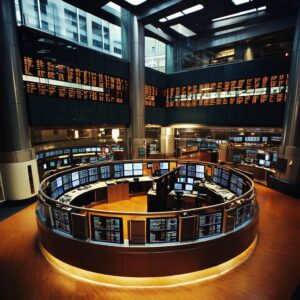

Highlighting the Shift to Algorithmic Approaches

In today’s fast-paced financial landscape, automated decisions are no longer a luxury—they’re a necessity for savvy investors.

Developing Crypto Bots for Cross-Chain Trading

Developing crypto bots for cross-chain trading

In the emerging landscape of decentralized finance (DeFi), over $80 billion currently flows through various blockchain networks, and the demand for efficient trading strategies has never been higher. As the crypto market continues to evolve, traders are increasingly turning to automated solutions–particularly crypto bots–to optimize their trading strategies. Among these strategies, cross-chain trading has emerged as a compelling approach, enabling traders to take advantage of price discrepancies across different blockchains.

This article delves into the significance of developing crypto bots specifically for cross-chain trading, highlighting their capabilities to facilitate seamless transactions and unlock arbitrage opportunities. Well explore the intricacies involved in creating these bots, the technological frameworks typically employed, and the benefits they offer traders seeking to navigate the complexities of multi-chain ecosystems. Ultimately, this guide aims to equip you with the knowledge needed to harness the potential of automated trading in the ever-expanding world of blockchain.

Understanding the Basics

Crypto bots

Understanding the basics of cross-chain trading and the development of crypto bots is essential for anyone looking to navigate the increasingly complex landscape of cryptocurrency markets. At its core, cross-chain trading refers to the ability to trade assets across different blockchain networks. For example, traders might switch between assets like Ethereum (ETH) and Bitcoin (BTC) or even explore altcoins on less prominent networks, such as Binance Smart Chain (BSC) or Solana. This capability allows for more diversified trading strategies and can assist in capitalizing on arbitrage opportunities.

Crypto bots, on the other hand, are automated software programs that execute trades based on predetermined criteria, such as price movements or trading signals. These bots operate tirelessly, enabling traders to take advantage of market fluctuations 24/7. According to a report by Statista, approximately 36% of crypto traders use automated trading bots to enhance their trading efficiency, which highlights the growing reliance on these tools within the crypto ecosystem.

The development of cross-chain crypto bots involves utilizing multiple tools and protocols to facilitate trading across different blockchains. Tools such as Polkadot and Cosmos are specifically designed to promote interoperability among blockchains. This means that developers can leverage unique features and decentralized exchanges (DEXs) across multiple networks without being restricted to one particular blockchain, thus increasing the number of trading opportunities available.

But, its important to acknowledge the challenges associated with developing effective cross-chain trading bots. These include issues such as differing transaction times, varying liquidity levels across chains, and smart contract complexities. To illustrate, while executing a trade between Ethereum and BSC, the transaction speed on Ethereum can greatly impact how quickly a trader executes an arbitrage opportunity; thus, developers must carefully account for these variables to optimize performance.

Key Components

Cross-chain trading

Developing crypto bots for cross-chain trading involves several key components that ensure efficiency, accuracy, and profitability. Understanding these components is essential for creating a robust trading strategy that navigates the complexities of multiple blockchain networks. Here are the primary elements to consider

- API Integration: Successful trading bots must integrate with the Application Programming Interfaces (APIs) of various exchanges across different chains. For example, using RESTful APIs from platforms like Binance or decentralized exchanges (DEXs) such as Uniswap provides crucial real-time market data and transactional capabilities. This integration allows the bot to execute trades based on predefined algorithms and market conditions.

- Smart Contract Utilization: To facilitate seamless cross-chain trading, bots can leverage smart contracts. These self-executing contracts automate processes, reduce the risk of fraud, and ensure transparency. For example, projects like Polkadot and Cosmos utilize their respective protocols to enable communication between different blockchains, allowing bots to execute trades without intermediaries.

- Risk Management Strategies: A robust risk management framework is vital to safeguard against the volatility inherent in cryptocurrency markets. Developers should implement stop-loss orders, position sizing techniques, and risk-reward ratios. According to a report from Deloitte, nearly 90% of retail traders do not employ strict risk management tactics, which can lead to significant losses. A well-structured trading bot with an embedded risk management strategy can mitigate this risk.

- Market Analysis Algorithms: Building effective market analysis algorithms is crucial for anticipating price movements. Techniques such as sentiment analysis, technical indicators, and machine learning models can help predict market trends. For example, a trading bot could use historical price data and moving averages to identify potential entry and exit points, thereby improving the likelihood of profitable trades.

By incorporating these components, developers can create sophisticated crypto bots tailored for cross-chain trading. Ensuring seamless API integration, utilizing smart contracts, implementing robust risk management practices, and employing advanced market analysis algorithms will significantly enhance the bots performance in a decentralized trading landscape.

Best Practices

Decentralized finance

Developing crypto bots for cross-chain trading involves several best practices that ensure efficiency, reliability, and security. As the cryptocurrency space evolves, these practices help traders navigate the complexities of decentralized networks and digital asset exchanges. Here are key recommendations to keep in mind when creating your trading bots.

- Perform Robust Due Diligence Before integrating multiple blockchains into your bot, thorough research is essential. Understand the characteristics of the chains you are trading on, such as transaction speeds, fees, and security measures. For example, Ethereum is known for its smart contract flexibility, while Binance Smart Chain offers lower transaction fees.

- Use Effective APIs: Employ APIs from leading exchanges to facilitate seamless trades across different chains. Leverage well-documented exchange libraries to minimize integration issues. Reliable APIs, such as those from Binance or Coinbase, provide features like real-time data, which are crucial for making informed trading decisions.

- Use Risk Management Strategies: Given the volatility associated with crypto assets, its imperative to establish stringent risk management protocols. This might include setting stop-loss orders or diversifying your portfolio across various tokens. A recent study by CoinMarketCap highlights that traders using automated strategies can reduce losses by up to 30% compared to manual trading in high-volatility conditions.

- Prioritize Security Measures: Given the reputation for security breaches in crypto, investing in proper security protocols is non-negotiable. Use hardware wallets for fund storage, implement regular updates, and conduct security audits on your bot software. According to a report by CipherTrace, theft from exchanges and wallets amounted to over $1.9 billion in 2020, underscoring the need for enhanced security practices.

By adhering to these best practices, developers can build more efficient and secure crypto trading bots that effectively operate in a cross-chain environment. Staying informed about technological advancements and evolving trading strategies will also further enhance your trading efficacy in this dynamic landscape.

Practical Implementation

Automated trading strategies

Practical Useation

Developing Crypto Bots for Cross-Chain Trading: Blockchain networks

Creating a crypto trading bot for cross-chain trading can be a complex yet rewarding task. Below, I provide a step-by-step guide to set up such a bot, supported by code examples and relevant tools. This guide assumes a working knowledge of programming and blockchain concepts.

Step 1: Define Trading Strategy

Before diving into the coding, establish a clear trading strategy. Determine criteria like:

- Entry and exit points based on technical indicators (e.g., Moving Averages, RSI).

- Risk management parameters (maximum loss per trade).

- Specific cross-chain opportunities to exploit.

Step 2: Choose Technology Stack

Selecting the right tools is crucial for effective development:

- Programming Language: Python is widely used for its simplicity and the availability of libraries.

- APIs: Use platforms like Binance API, Ethereum Web3.js, and Polkadot.js.

- Data Libraries: Pandas for data analysis, NumPy for numerical operations.

Example Libraries:

- Pandas – for data manipulation.

- NumPy – for numerical calculations.

- CCXT – for interacting with various exchanges seamlessly.

Step 3: Set Up Your Development Environment

Youll need a development environment with the necessary libraries:

pip install pandas numpy ccxt web3Step 4: Connect to APIs

Use the APIs of different exchanges to fetch market data. Heres a sample of how to connect to Binance:

import ccxt# Connect to Binancebinance = ccxt.binance({ apiKey: YOUR_API_KEY, secret: YOUR_API_SECRET,})# Fetch market datamarkets = binance.fetch_markets()print(markets)Step 5: Use Trading Logic

Heres a pseudocode example for a simple moving average strategy:

def trading_strategy(market_data): short_window = 40 long_window = 100 signals = pd.DataFrame(index=market_data.index) signals[price] = market_data[close] signals[short_mavg] = market_data[close].rolling(window=short_window).mean() signals[long_mavg] = market_data[close].rolling(window=long_window).mean() signals[signal] = 0.0 signals[signal][short_window:] = np.where(signals[short_mavg][short_window:] > signals[long_mavg][short_window:], 1.0, 0.0) return signalsStep 6: Executing Trades

Once the strategy is defined, implementing buy/sell orders is next. An example for placing a market buy order in Binance:

# Market Order Exampleamount = 0.1 # Define the amount to tradeorder = binance.create_market_buy_order(BTC/USDT, amount)print(order)Step 7: Monitoring and Logging

Track your bots performance and keep logs for analysis. Use logging as follows:

import logginglogging.basicConfig(filename=trading_bot.log, level=logging.INFO, format=%(asctime)s - %(levelname)s - %(message)s)# Log buy orderlogging.info(Executed buy order: %s, order)Challenges and Solutions

As you develop your trading bot, you may encounter the following challenges

Conclusion

To wrap up, the development of crypto bots for cross-chain trading represents a significant evolution in the landscape of cryptocurrency trading. Throughout this article, we explored the fundamentals of cross-chain exchanges, the strategic advantages offered by automated trading bots, and the technical considerations involved in their development. By leveraging advanced algorithms and real-time market analysis, crypto bots can enhance trading efficiency, mitigate risks, and ultimately lead to more profitable outcomes for traders navigating the complex ecosystem of multiple blockchain networks.

As the cryptocurrency market continues to grow in complexity and diversity, the integration of cross-chain trading capabilities and automated strategies will likely become indispensable tools for serious investors. significance of this topic cannot be overstated; the future of trading may well hinge on the ability to adapt to rapidly changing conditions across various chains. So, whether you are a seasoned trader or a newcomer, embracing this technology could open up new avenues for financial success. Now, the question remains

are you ready to harness the power of crypto bots to elevate your trading strategies in this dynamic market?