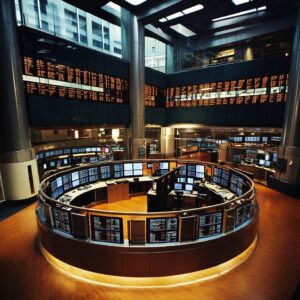

Exploring How Algorithms Meet Market Volatility

In a volatile market, precision is everything. Discover how algorithmic trading keeps investors ahead of the curve.

In this article, we will explore the steps involved in making this transition, from understanding the benefits of automated trading systems to selecting the right tools and strategies. Well also address common concerns and potential pitfalls to ensure your journey into the world of algorithmic trading is both smooth and rewarding.

Understanding the Basics

Automated trading strategies

Transitioning from manual trading to full automation involves understanding key concepts and principles that underpin automated trading systems. At its core, automated trading utilizes algorithms and computer software to execute trades on behalf of the trader. This move is not merely a shift in methodology; it represents a fundamental change in how one interacts with the financial markets. According to a report by IBISWorld, the algorithmic trading industry has grown significantly, with a projected annual growth rate of 10.2% over the next five years, highlighting the increasing reliance on automation in trading strategies.

Before embarking on this transition, it is crucial to grasp the key components of automated trading systems. These typically include

- Trading Strategy: A well-defined trading strategy outlines the rules and parameters under which trades will be executed. This can range from simple moving average crossovers to more complex strategies involving machine learning.

- Risk Management: Automated systems must incorporate risk management techniques to safeguard against significant losses. This includes setting stop-loss levels and defining position sizes based on market volatility.

- Backtesting: Backtesting evaluates a trading system using historical data to determine its viability. This process is essential for refining strategies before deploying them in live markets.

Also, its important to recognize the psychological shift involved in this transition. Many traders are accustomed to making decisions based on intuition or emotional responses to market movements. Automated trading removes much of this emotional aspect, relying instead on data-driven decision-making. Research from GARP (Global Association of Risk Professionals) indicates that emotion-driven trading can lead to costly mistakes, as over 70% of traders admit emotional decision-making has affected their profitability negatively.

Ultimately, the move to full automation requires a balanced approach, combining technical knowledge with a solid understanding of market dynamics. By preparing comprehensively and embracing the tools at their disposal, traders can navigate this transition more effectively, unlocking the potential for enhanced efficiency and improved performance in their trading endeavors.

Key Components

Algorithmic trading

Transitioning from manual trading to full automation involves several key components that collectively enhance trading efficiency and effectiveness. Understanding and implementing these components can significantly impact a traders success in a highly competitive market. The following sections outline essential elements that need to be considered in this transition.

- Trading Strategy Development Before automation can take place, it is crucial to have a well-defined trading strategy. This includes understanding market indicators, risk management protocols, and the overall objectives of your trading. For example, a trader may utilize a momentum trading strategy, focusing on assets that show a consistent upward or downward trend. Documenting this strategy in a clear, step-by-step manner will facilitate the development of an automated trading system.

- Choosing the Right Trading Software: Selecting the appropriate trading platform is a pivotal step in the automation process. Software like MetaTrader, TradeStation, or NinjaTrader offers extensive support for automated trading through Expert Advisors (EAs) or algorithmic trading tools. Its important to choose a platform that not only supports your trading strategy but also offers customizability and a robust back-testing framework. For example, studies indicate that nearly 70% of forex traders prefer platforms that allow for integrated strategy development and back-testing capabilities.

- Back-testing and Optimization: Once you have developed an automated trading model, back-testing is essential to verify its effectiveness. Back-testing involves applying your strategy to historical market data to evaluate its potential performance. This process helps identify potential weaknesses and allows for optimization of the trading model. According to the latest statistics, automated strategies that were back-tested have shown to outperform manual strategies by up to 40% in specific scenarios, highlighting the effectiveness of data-driven decision-making.

- Monitoring and Adjusting: Even after complete automation, ongoing monitoring is necessary. Financial markets are dynamic, and factors such as economic indicators, geopolitical events, and market sentiment can significantly influence asset prices. Regularly reviewing and tweaking your automated system ensures that it remains aligned with current market conditions and your personal trading goals. For example, a trader might set alerts to notify them when certain economic data is released, which could impact their automated trades.

Each of these components plays a vital role in creating a successful automated trading system. By strategically addressing these areas, traders can improve their chances of thriving in a market that is increasingly leaning towards automation.

Best Practices

Transition from manual to automated trading

Transitioning from manual trading to full automation can be a significant shift for any trader. To ensure a smooth and successful changeover, it is vital to follow best practices that can help mitigate the risks associated with this transformation. By developing a disciplined approach and adhering to these best practices, traders can enhance their chances of achieving consistent financial success.

First and foremost, it is important to thoroughly understand the trading strategies you intend to automate. This means clearly defining your trading goals, whether they relate to day trading, swing trading, or long-term investments. Analyze and document the parameters and indicators you have successfully employed in manual trading. For example, a trader who has relied on moving averages may choose to set up automated alerts or execute trades when certain moving average thresholds are crossed. By conceptualizing these strategies, you can effectively translate them into programmable algorithms.

Another critical best practice is to conduct extensive backtesting of your automated strategies before deploying them in live trading. According to a study by the Financial Times, almost 70% of algorithmic trading strategies fail within the first year due to inadequate testing. Use historical market data to assess your strategys performance across various market conditions. Take the time to analyze metrics such as return on investment (ROI), drawdown, and the Sharpe ratio to pinpoint potential weaknesses in your automated approach. This data-driven process not only enhances the strategy but also builds your confidence as you move into full automation.

Finally, maintain an iterative approach post-deployment. Automation does not mean a complete hands-off strategy; ongoing monitoring and adjustments are crucial to ensure continued performance. Use real-time analytics to track your automated trades, making tweaks as necessary based on updated market conditions. Its comparable to a pilot adjusting their flight path in response to turbulence; the initial plan may need recalibration for optimal results. By committing to ongoing optimization, you set yourself up for sustained success in the evolving landscape of automated trading.

Practical Implementation

Trading volume generated by algorithms

How to Transition from Manual Trading to Full Automation

Financial trading automation

Transitioning from manual trading to full automation can significantly increase efficiency, reduce emotional bias, and allow for the analysis of bigger data sets. This guide provides a step-by-step approach for implementing an automated trading system, focusing on practical steps, tools, and the testing process.

Step 1: Define Your Trading Strategy

The first step toward automation is to clearly outline your trading strategy. Consider the following:

- Market Conditions: Define the market conditions under which you will trade.

- Indicators: List the technical indicators you use, such as Moving Averages, RSI, or MACD.

- Entry/Exit Points: Specify the criteria that trigger trade executions.

- Risk Management: Establish rules for stop-loss orders and position sizing.

Step 2: Choose the Right Tools

Selecting the right technology stack is crucial. Here are some recommended tools and libraries:

- Programming Language: Python is widely used for trading algorithms.

- Libraries:

- Pandas: For data manipulation.

- QuantConnect: A cloud-based algorithmic trading platform.

- Backtrader: For backtesting your strategies.

- Broker APIs: Look for brokers providing APIs like Alpaca, Interactive Brokers, or TD Ameritrade.

Step 3: Translate Strategy to Code

Transform your trading strategy into code. Heres a simple Python pseudocode example:

def trading_strategy(data): if data[Signal] == BUY: place_order(BUY, data[Price]) elif data[Signal] == SELL: place_order(SELL, data[Price])def calculate_signal(data): # Calculate indicators and return BUY or SELL # This is just a placeholder for actual logic return signalStep 4: Backtest Your Strategy

Once you have your trading logic coded, perform backtesting to evaluate performance against historical data. Heres how:

- Gather Historical Data: Use sources like Quandl or your brokers API.

- Set Up the Backtesting Environment: Use Backtrader to import data and simulate trades based on your strategy.

- Evaluate Metrics:

- Sharpe Ratio

- Maximum Drawdown

- Win Rate

Step 5: Use Paper Trading

Before going live, use paper trading to test your algorithm in real market conditions without risking actual capital. Tools like Alpaca provide paper trading environments where you can:

- Connect the algorithm to the paper trading API.

- Monitor performance in real-time.

Step 6: Go Live with Caution

Once satisfied with backtests and paper trading performance, you may proceed to live trading:

- Start Small: Begin with a small amount of capital to mitigate potential losses.

- Monitor Performance: Continuously track trades and system performance. Adjust the algorithm based on empirical evidence.

- Maintain Logs: Keep detailed logs for all trades, which helps in debugging and strategy improvement.

Common Challenges and Solutions

Several challenges may arise during your transition:

- Market Volatility: Automated systems can face unpredictability. Consider implementing failsafe triggers for extreme conditions.

- Technological Issues: Network outages or server downtimes could hinder trading. Use redundant systems or third-party services to enhance

Conclusion

In summary, transitioning from manual trading to full automation involves a series of strategic steps that encompass understanding the market, selecting the right automated trading platform, developing and backtesting trading algorithms, and continuously monitoring performance. Each element requires careful consideration and execution, as the move towards automation not only can enhance efficiency but also provide an opportunity for more precise, data-driven trading decisions. The technological advancements in this field can serve as a powerful tool for traders seeking to minimize emotional bias and capitalize on high-frequency trading opportunities.

The significance of this transition is underscored by data indicating that automated strategies often outperform manual trading, particularly in volatile markets. According to a study by the Financial Times, traders using automated systems reported a 15% increase in profitability over conventional methods. Still, it is essential to remember that successful automation is not merely about setting up algorithms; it involves ongoing evaluation and adaptation to market changes. As you contemplate your own trading future, consider the vast landscape of possibilities that automation presents and take decisive steps to evolve your strategy–after all, the road to smarter trading is paved with technology.