Emphasizing the Role of Technology

As technology drives innovation in financial markets, understanding algorithmic trading is crucial for any forward-thinking investor.

In this article, we will explore the mechanics of developing AI trading bots specifically tailored for DEXs, the technologies involved, and the potential benefits and pitfalls that traders should consider. We aim to arm readers with the knowledge they need to harness the power of AI, enhancing their trading strategies in this dynamic realm.

Understanding the Basics

Ai trading bots

Understanding the fundamentals of building AI bots for trading on decentralized cryptocurrency exchanges (DEXs) is essential for both newcomers and seasoned traders. In contrast to centralized exchanges, which rely on intermediaries to facilitate transactions, DEXs utilize blockchain technology to enable peer-to-peer trading. This decentralization offers enhanced security and reduced fees but introduces unique challenges that AI bots must navigate.

At its core, an AI trading bot leverages machine learning algorithms and data analytics to make informed trading decisions. e bots can analyze vast datasets, including historical price movements, trading volumes, and market sentiment, to predict future trends. For example, according to a study by the Cambridge Centre for Alternative Finance, the global number of active cryptocurrency users is estimated to have reached over 300 million by mid-2021, resulting in an enormous volume of trading data available for analysis.

Plus, building a trading bot for DEXs necessitates an understanding of the specific protocols involved, such as Ethereums ERC-20 standard or Binance Smart Chains BEP-20 tokens. These protocols dictate how tokens are issued and interact within the decentralized ecosystem. Familiarity with decentralized finance (DeFi) concepts, like automated market makers (AMMs) and liquidity pools, is also crucial. Bots can utilize these mechanisms to optimize trades, enhance liquidity, and minimize slippage, driving profitability for users.

To create a successful AI trading bot on a DEX, one must also consider factors such as transaction speed and gas fees, which directly impact trading performance. For example, average gas fees on Ethereum have fluctuated widely, reaching as high as $70 during peak trading periods in 2021. This complexity underscores the importance of designing bots that can efficiently manage these costs while executing trades in real time, ensuring users can capitalize on price movements without excessive overhead.

Key Components

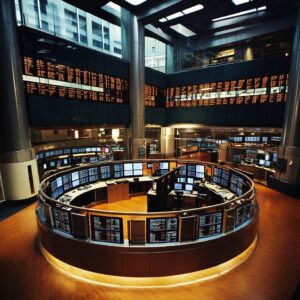

Decentralized exchanges

Building AI bots for trading on decentralized crypto exchanges involves several key components that are essential for optimizing trading strategies and ensuring efficient operations. Each of these components plays a critical role in the functionality and performance of the trading bots. Below are the primary elements to consider

- Data Acquisition: The foundation of any AI trading bot is its data. Accessing real-time and historical market data is crucial. APIs from decentralized exchanges like Uniswap and SushiSwap offer this data, enabling bots to analyze trends, price fluctuations, and trading volumes. For example, according to Dune Analytics, the trading volume on decentralized exchanges reached over $1 trillion in 2021, highlighting the importance of accurate data gathering.

- Algorithm Development: The algorithms drive the decision-making process of the bots. Traders often use machine learning techniques to create predictive models based on historical data. A commonly used approach is reinforcement learning, where the bot learns to optimize its trading strategy through trial and error. For example, an algorithm may identify patterns that signal when to buy or sell assets, thus increasing profitability.

- Risk Management: Useing robust risk management strategies is essential to protect capital in highly volatile markets like cryptocurrencies. This can involve setting parameters for loss limits, diversifying asset portfolios, and using stop-loss orders. According to a 2023 study by Crypto Research Report, 70% of traders using automated systems without proper risk management experienced significant losses, underscoring its importance.

- Integration with Smart Contracts: Decentralized exchanges operate on blockchain technology, where smart contracts facilitate trades. Building bots to interact seamlessly with these contracts is essential. Bot developers need to understand Solidity (the programming language for Ethereum smart contracts) to ensure that transactions are executed correctly and efficiently. Misalignment in contract interaction can result in failed transactions, leading to financial loss.

To wrap up, a successful AI trading bot requires a well-rounded approach that combines effective data acquisition, algorithm development, risk management, and integration with smart contracts. By focusing on these key components, traders can harness the power of artificial intelligence to navigate the complexities of decentralized crypto exchanges effectively.

Best Practices

Cryptocurrency trading strategies

Building AI bots for trading on decentralized crypto exchanges requires a strategic approach that balances innovative technology with prudent risk management. To enhance the efficiency and effectiveness of your trading bots, consider the following best practices.

- Understand Market Dynamics Familiarize yourself with the specific characteristics of decentralized exchanges (DEXs) compared to centralized ones. DEXs often experience higher volatility and slippage, impacting order fulfillment and pricing accuracy. By analyzing historical trading data, you can derive insights on liquidity patterns and user behavior, enabling your bot to adapt its strategies in response to market trends.

- Leverage Machine Learning Algorithms: Use predictive machine learning algorithms to forecast price movements based on historical data. Techniques such as reinforcement learning can help your bot learn optimal trading strategies through trial and error. For example, using tools like TensorFlow or PyTorch, traders have effectively developed algorithms that can improve performance by over 20% through continual learning and adaptation.

- Use Robust Security Measures: Security should be paramount when developing trading bots for DEXs. Using smart contract audits, two-factor authentication, and secure coding practices can prevent vulnerabilities. According to a report by Chainalysis, around $2.8 billion was lost in cryptocurrency hacks in 2021 alone. So, proactively addressing security could save significant capital and influence user trust.

- Backtesting and Simulation: Before deploying your bot, conduct thorough backtesting against historical data to evaluate its performance under various market scenarios. Tools like TradingView or CoinMarketCap provide backtesting functionalities that enable developers to simulate trading strategies without real financial risk. This step can highlight potential flaws and adjustments needed before going live on a DEX.

By adhering to these best practices, traders can build more reliable and effective AI bots for trading on decentralized crypto exchanges. The key is to blend advanced technology with a comprehensive understanding of market mechanics to foster a robust trading environment.

Practical Implementation

Artificial intelligence in defi

Building AI Bots for Trading on Decentralized Crypto Exchanges

Artificial intelligence (AI) bots have become a powerful tool for trading on decentralized exchanges (DEXs) due to their ability to analyze vast amounts of data swiftly and execute trades at optimal prices. This guide outlines a practical implementation of AI trading bots tailored for DEXs.

Step 1

Understand the Fundamentals: Total value locked in defi

Before diving into building an AI trading bot, ensure that you have a solid grasp of blockchain technology, particularly how DEXs operate. Familiarize yourself with terms such as liquidity pools, AMMs (Automated Market Makers), and trading pairs.

Step 2: Choose Your Tools and Libraries

You will need the following tools and libraries:

- Python: The primary programming language for our bot.

- Web3.py: A Python library for interacting with Ethereum.

- CCXT: A library to connect with various exchanges.

- Pandas: For data manipulation and analysis.

- NumPy: For mathematical functions.

- TensorFlow or PyTorch: For implementing machine learning models.

- Docker: For containerizing your application, making deployment easier.

Step 3: Set Up Your Environment

- Install Python on your system along with pip (Pythons package installer).

- Use pip to install required libraries:

pip install web3 ccxt pandas numpy tensorflow - Set up a virtual environment to manage dependencies:

python -m venv myenvsource myenv/bin/activate

Step 4: Connect to the DEX

Use the Web3.py library to interact with Ethereum-based DEXs like Uniswap or SushiSwap. Heres a basic example to connect:

from web3 import Web3# Connect to Ethereuminfura_url = https://mainnet.infura.io/v3/YOUR_INFURA_PROJECT_IDweb3 = Web3(Web3.HTTPProvider(infura_url))if web3.isConnected(): print(Successfully connected to Ethereum)else: print(Connection failed)Step 5: Use the Trading Strategy

Your trading strategy can be based on various approaches such as trend following, arbitrage, or a machine learning model. Below is a basic pseudocode example for a trend-following strategy:

def trend_following_strategy(signal): if signal == buy: execute_trade(buy) elif signal == sell: execute_trade(sell)def execute_trade(action): # Logic to execute trade via DEX API passStep 6: Integrate Machine Learning

Train your AI model on historical trading data to predict future market movements. The following is a simple framework using TensorFlow:

import numpy as npfrom tensorflow import keras# Load historical price datadata = load_data(price_data.csv)X_train, y_train = preprocess_data(data)model = keras.Sequential([ keras.layers.Dense(128, activation=relu, input_shape=(X_train.shape[1],)), keras.layers.Dense(64, activation=relu), keras.layers.Dense(1)])model.compile(optimizer=adam, loss=mean_squared_error)model.fit(X_train, y_train, epochs=20)Step 7: Backtesting

Before deploying your bot, its crucial to test it against historical data. Backtesting enables you to simulate trades based on past market conditions:

def backtest_strategy(data, strategy): for index, row in data.iterrows(): signal = strategy(row) # Simulate trade simulate_trade(signal)Step 8: Deployment and Monitoring

Containerize your application with Docker to simplify deployment:

FROM python:3.8-slimCOPY . /appWORKDIR /appRUN pip install -r requirements.txtCMD [python, trading_bot.py]</codeConclusion

To wrap up, building AI bots for trading on decentralized crypto exchanges represents a significant evolution in the realms of finance and technology. We explored how these bots leverage advanced algorithms to analyze market trends, execute trades with precision, and help traders capitalize on fleeting opportunities in the ever-volatile cryptocurrency landscape. Coupled with the inherent advantages of decentralization–such as enhanced security and reduced reliance on intermediaries–AI trading bots are not just tools; they are redefining the landscape of trading as we know it.

The significance of integrating AI with decentralized exchanges cannot be overstated. As more investors embrace digital assets, understanding the mechanics and technologies that drive these innovations will be crucial. By equipping oneself with the knowledge of how AI bots function, traders can better navigate the complexities of decentralized finance (DeFi) and potentially achieve greater financial independence. As we move forward, consider taking the plunge into this rapidly evolving space–after all, the future of trading could well depend on how effectively we harness the power of AI.